Danske Bank has posted its figures for the first six months of 2020, showing the impact that the coroanvirus outbreak has had on banks in Northern Ireland.

Financial institutions across the world are being impacted by the coronavirus outbreak and lockdown, and Northern Ireland is no exception. The Bank of England slashed interest rates early in the pandemic as an emergency measure to boost the economy and stinulate borrowing, and the UK government has launched several financial schemes to protect workers and businesses.

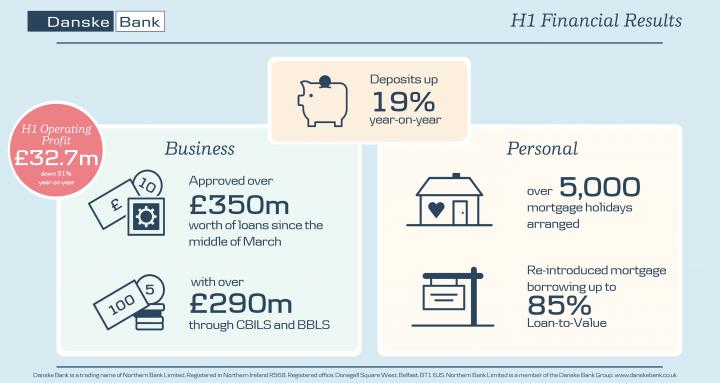

Danske Bank reports that its income is down by 12% as a result of the reduced interest rates and the disruption caused by the virus. Lending has been mostly affected this year by business customer support in response to coronavirus disruption and some mortgage growth at the start of the year, but many customers have used this time to pay off debt, causing 19 year-on-year deposit growth.

"Customers, both personal and business, are saving more than ever, leading to a year-on-year rise in deposits of 19%," explained Kevin Kingston, CEO of Danske Bank UK. "The uplift in deposits in Q2, coinciding with the lockdown period, was particularly significant, totalling almost £1 billion. If we are to get the Northern Ireland economy moving again, a lot will depend on how much of this pent up economic capacity turns into consumer spending and business investment."

The big headlines for corporate and business banking include over £350m of coronavirus related business support loans being made since mid-March when the government announced its backed loan scheme. The Coronavirus Business Interruption Loan scheme and Bounce Back Loan Scheme account for over £290m of this support, with lending made to over 8,500 local businesses.

Kevin Kingston commented on the situation in Northern Ireland: "I would like to commend the Northern Ireland Executive for its work in recent months to support the private sector, noting there is much more hard work to be done. Uncertainty around Brexit outcomes for Northern Ireland still prevail, and the business community and political representatives must continue to work closely together if we are to safeguard our fragile economy."

Source: Written based on press release